Get started

Get started

Bitcoin meets the need for a payment system that is not based on trust. It brings sovereignty to its user by giving them a way to transfer money without the intervention of a trusted third party. This promise necessarily involves keeping your bitcoins yourself. In English, this is called “self-custody”.

In this article, I explain to you what bitcoins are in practice and how to store them securely. It discusses some technical concepts necessary to understand self-custody.

Bitcoins don't exist physically. They are simply electronic money units of account that can be traded on the Bitcoin system. So, bitcoin always stays on Bitcoin. You can't literally store them. On the other hand, what you can store yourself are the keys that allow access to them.

As with any other currency, units of account must have a medium. On Bitcoin, this medium is called “UTXO”. In English, this means “Unspent Transaction Output”, which can be translated as “unspent transaction output”. To understand this concept, let's draw an analogy. In the classical system you are familiar with, the euro is the unit of account. To represent this unit physically, it is stamped on a bank note. The ticket embodies unity, it is its support. On Bitcoin, it's the same! The unit is Bitcoin (BTC), and the support for this unit is UTXO. So UTXOs are simply pieces of bitcoin potentially belonging to a user.

On the Bitcoin system, UTXOs are blocked by spending conditions. To be able to spend the bitcoins that belong to you, you will have to prove to the rest of the network that you are the legitimate owner. This proof is embodied in the satisfaction of the expenditure condition attached to a given UTXO. When you receive a piece of Bitcoin, you put a condition on it that defines how it can be spent in the future. When you want to spend it, you meet this spending requirement and the rest of the network accepts the transaction.

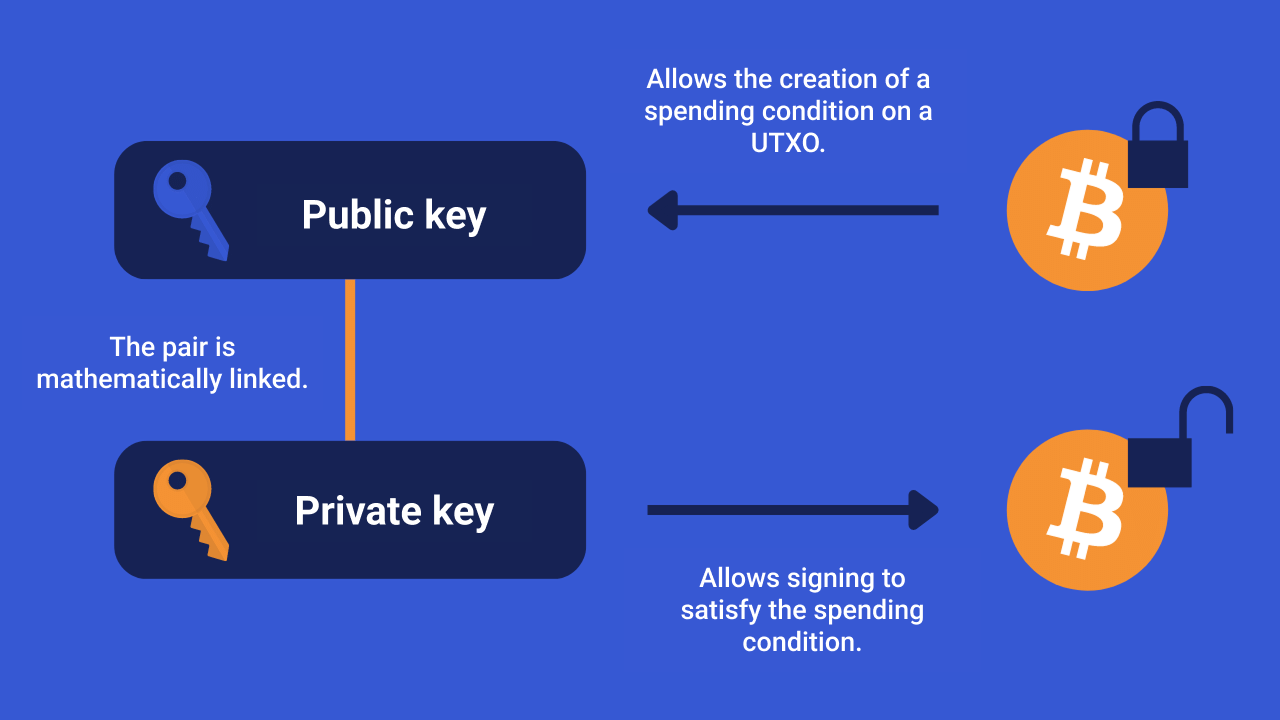

While this is not the only way to block UTXOs, a cryptographic key pair is generally used to create and satisfy the spending condition. A user who wants to spend some of his UTXO will then have to produce proof that he is aware of a certain key. The proof makes it possible to meet the condition of spending a UTXO, and therefore to unlock the associated bitcoins. It is thus the knowledge of this key that embodies the ownership of bitcoins. Therefore, when we talk about “storing bitcoins”, in the end, it is equivalent to storing the keys that give access to bitcoins yourself.

To summarize:

➤ Learn more about how the Bitcoin protocol works.

As with traditional monetary systems, on Bitcoin, it is important to clearly differentiate between third-party storage services and autonomous custody.

Crypto exchanges often offer to keep your bitcoins for you. When you choose this option, the keys to unlock your bitcoins are stored by the entity. In this case, you are not really the owner of your bitcoins. It is the platform that owns them for you. She represents this debt by noting the amount she owes you on your customer account. It is similar to that of a traditional bank.

On the other hand, self-custody is an approach that consists in storing your bitcoins independently, without using the services of a trusted third party. In other words, clean keeping means that you are solely responsible for your Bitcoin wallet and the safety of your funds. Concretely, self-custody is the fact of keeping the keys giving access to your bitcoins yourself.

When you keep your keys, you take total control of your funds. This allows you to manage your transactions independently and to make decisions about managing your funds independently. You can thus enjoy all the advantages of using Bitcoin: your transactions are incensurable as long as you have access to a network node and you can put in place strategies to maintain your privacy. Above all, you no longer need to trust a third party for the proper preservation of your currency.

Bitcoin was designed for the user to manage their own keys themselves. One of Satoshi Nakamoto's main motivations, as mentioned in the Bitcoin White Paper, was to completely do without the need to trust a financial institution.

“The need is to have an electronic payment system based on cryptographic proof instead of trust, allowing two willing parties to carry out transactions between them without the need for a trusted third party.”

This means that you are free to make your own choices, but you are also responsible for their consequences. If you choose standalone custody, you will be solely responsible for your bitcoins. If you lose access to your keys, or if they are stolen, your bitcoins will be lost forever. No recourse is possible since there is no entity behind the system. It is therefore absolutely essential to learn about how Bitcoin works in order not to make mistakes in its use. That's good news, that's the whole purpose of the Understanding Bitcoin blog!

➤ Subscribe to our newsletter to make sure you don't miss out on future articles.

A Bitcoin wallet (or “wallet” in English) is a specific computer software that makes it possible to store cryptographic keys, and to produce signatures (proofs) to unlock the user's bitcoins.

The term “wallet” was very poorly chosen. Most newbies think that a Bitcoin wallet stores bitcoin directly, in the same way that a physical wallet stores bills. But that is not the case. The Bitcoin wallet only keeps the keys that give access to the bitcoins on the system. Finally, its operation is more like that of a keychain than that of a wallet. It allows you to easily create, organize, and manipulate cryptographic keys in order to use Bitcoin. Some prefer to call it a “signing device”, which can be translated into French as “signature hardware”, in order to emphasize the wallet's digital signature production function.

The Bitcoin wallet can take many different forms. It can be computer software, a smartphone application or even a completely dedicated computer machine.

➤ Learn more about the different types of Bitcoin wallets.

Cryptographic key pairs, which allow bitcoin to be stored and spent, consist of two components: a private key and a public key. The public key makes it possible to generate spending conditions on a UTXO. The private key makes it possible to produce a signature (proof) in order to spend the bitcoins blocked by the associated public key.

Concretely, when you want to receive bitcoins, you will send one of your public keys to your payer. The latter will make a transaction and will send funds to your public key. It produces spending conditions indicating that the sum of bitcoins sent to you can only be spent if a certain digital signature is produced. This signature to unlock the bitcoins you have just received can only be produced with the private key associated with the public key used. Since you are the only person who knows this private key, you are the only person who can spend these bitcoins. As a result, you are in fact the owner of these funds.

In reality, the public key is often represented by a receiving address. An address is a summary of a public key with some additional data.

A private key is simply a random number, and a public key is a unique number derived from a private key. This pair is linked mathematically. A certain algorithm is used to determine a public key from a private key. This algorithm is irreversible. You can easily deduce a public key by knowing your private key, on the other hand, it is impossible to calculate the private key by knowing only the associated public key. So, public keys are not sensitive information to secure your funds. You can freely pass them on to people who want to send you bitcoin.

Your public keys, and by extension your addresses, still present risks of loss of confidentiality. A person who knows an address will be able to consult the balance of bitcoins blocked on it, without being able to spend this balance (it is the private key that allows this). It is therefore appropriate to limit the dissemination of this information and to avoid publishing it on social networks, for example.

On the other hand, the associated private keys are extremely sensitive information since they alone allow you to spend your bitcoins. Under no circumstances should you send them to another person, otherwise your funds will disappear.

➤ Discover our tutorial to easily set up a Bitcoin wallet.

Bitcoins are exchanged on media called “UTXO”. A UTXO is the equivalent of a ticket in the traditional banking system. The UTXOs that belong to you are blocked by conditions allowing them to be spent. These spending conditions are defined with your public keys.

On the other hand, to satisfy the condition and be able to spend your UTXO, you must produce a signature using the corresponding private keys. In short, the public key is used to create a script (that is, a set of instructions that describe how to access bitcoins) and the corresponding private key makes it possible to satisfy this script. It is therefore the knowledge of the associated private keys that embodies the ownership of bitcoins.

It is the responsibility of the user to take care of the security of his private keys. They give direct and unrestricted access to your bitcoins. If this information is lost or stolen, it is impossible to recover the associated bitcoins. They are lost forever.

The autonomous custody of its funds represents the true use of the Bitcoin payment system. If the user wants to take advantage of its many advantages, in particular the incensurability and the elusiveness of his bitcoins, he must imperatively keep and secure his keys himself.